Helping you make smarter decisions across every aspect of your financial life.

We help you create a clear, personalized roadmap that aligns your financial decisions with your goals.

We design investment strategies that are tax-aware, risk-adjusted, and built to reflect your unique priorities.

We help you build systems that support confident decision-making across generations.

Solutions built for the real-life events and long-term goals that shape your financial story.

Build retirement strategies focused on aligning your income and withdrawal plans with your long-term priorities.

Plan for major life shifts—new homes, growing families, or career changes—with proactive financial guidance.

Make informed decisions about stock options, equity compensation, and privately held business sales. Optimize for vesting, taxes, and diversification.

Build a smart education plan that balances growth potential, tax benefits, and long-term affordability.

Build a smart education plan that balances growth potential, tax benefits, and long-term affordability.

Develop estate plans that reflect your values and outline strategies for managing assets and potential tax considerations.

Turn generosity into impact with giving plans that align with your goals and optimize tax efficiency.

Design inheritance and gifting strategies that minimize tax exposure and preserve your legacy.

Keep your short-term needs covered while positioning excess cash for growth and opportunity.

Coordinate taxable and tax-deferred accounts to support a sustainable approach to income planning.

Plan for major expenses and unexpected events with flexible access to funds when needed.

Protect what matters most with coverage strategies that fit seamlessly into your broader plan.

Minimize taxes over time through intentional coordination of investments and income sources.

Align 401(k)s, IRAs, and other savings vehicles with your goals through informed contribution strategies.

Take advantage of conversion opportunities that can reduce future taxes and increase flexibility.

Find the right time to claim benefits to optimize lifetime income and long-term security.

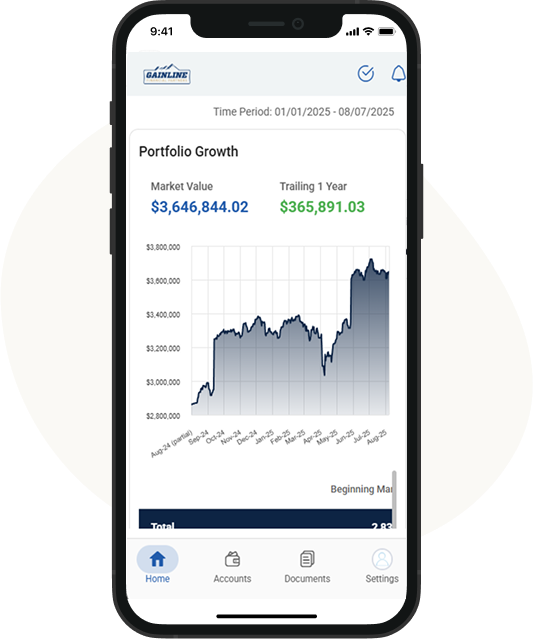

Your investments should support your full financial picture—not complicate it. We design portfolios that are tax-aware, plan-aligned, and built for long-term success.

We build your portfolio to match your financial plan and risk tolerance.

Our strategies help optimize your overall tax impact while staying focused on growth and stability over time.

Through strategic asset allocation, we help balance long-term growth and short-term needs.

Our bucket approach helps ensure you always have access to cash—without needing to sell in down markets.

It’s not just what you do with your money—it’s how you make decisions. We help you align your financial life with your values, goals, and real-world circumstances.

We help you recognize the habits and emotional triggers that shape your financial behavior. With the right systems in place, better decisions become easier and more automatic.

Planning isn’t just about the future. We work with you to make smart choices that support your life today while still preparing you for what’s ahead.

Whether you’re growing wealth or preparing to inherit it, we break down complex concepts and help you understand your options clearly, so you can move forward with confidence.

Get to know us, and see if we’re a fit.

Investment advisory services offered through Gainline Financial Partners, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission. Registration does not imply any level of skill or training. This website is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of the information provided at these web sites.